News

News

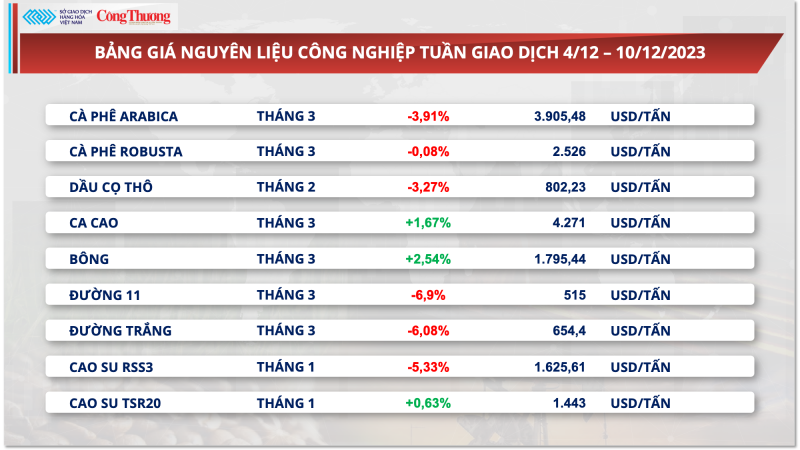

According to Vietnam Commodity Exchange (MXV), ending the trading week of December 4 - 10, two items < /span> also decreased by 3.91% for Arabica and 0.08% for Robusta. Inventory data recovering after a week of deep decline along with a positive outlook on the supply of new coffee crops in Brazil are two important reasons why prices turned around.coffee

|

| Coffee export prices turned down in the past week |

Inventories of standard Arabica on the European Intercontinental Exchange (ICE-US) last week increased by 10,633 bags of 60kg, bringing the total number of certified coffee to 234,699 bags, temporarily escaping the lowest level in more than 24 years confirmed last week.

The International Coffee Organization (ICO) predicts that the balance of coffee supply and demand in the 2023/24 crop year will have a surplus of about 1 million bags, instead of a deficit of nearly 5 million bags like in the last crop year. Rising output in Brazil and several other major producing countries is the reason for the current expected surplus. In November, this country exported more than 234,700 tons of coffee, 8% higher than the same period in 2022.

On the domestic market, recorded this morning (December 11), the price of green coffee in the Central Highlands and Southern provinces fluctuated between 60,400 - 60,600 VND/kg, moving sideways compared to the previous day.

Mr. Nguyen Duc Dung - Deputy General Director of MXV commented that in the first months of 2024, Vietnam's Robusta coffee supply will likely dominate the market share in the global market. With the amount of coffee available thanks to harvesting activities, it is expected that coffee prices will decrease in the short term. However, the adjustment will be relatively gentle and the price may anchor above 2,300 USD/ton.

|

| Vietnam's coffee exports are still increasing |

In fact, Vietnam's coffee exports are still continuing a positive trend. For coffee exports, according to the General Department of Customs, coffee exports nationwide as of the end of November reached about 3.5 billion USD. In the context of world scarcity of supply, pushing prices up, Vietnam is entering the harvest season, the coffee industry expects to have a vibrant business season at the end of the year. Up to now, this enterprise has exported about 150,000 tons of coffee of all kinds, of which mainly raw coffee.

Export turnover also grew quite well over the same period, thanks to the sharp increase in coffee prices, from 1,000 USD/ton a few years ago, up to now it has increased 3 times. This is the result of improving product quality thanks to changing thinking from farmers' production to businesses' processing.

In the first 11 months of 2023, the country's coffee exports will reach about 3.5 billion USD. Trade activities will continue to be vibrant in the last months of the year, when Vietnam is at the peak of the new crop harvest. Notably, coffee export prices in October continued to set a new record of over 3,600 USD per ton, up nearly 9% compared to September and up 40.7% over the same period. This will be the driving force for businesses to continue taking advantage of opportunities to increase exports.

Regarding the market, in October 2023, Vietnam's coffee exports to the US reached approximately 1,760 tons, worth about 6.31 million USD, an increase of 11.2% in volume and an increase of 22.2% in value compared to compared to the previous month, but decreased sharply by 78.8% in volume and 69.3% in value compared to the same period in 2022.

In the 10 months of 2023, Vietnam exported nearly 93,840 tons of coffee to the US, earning 225 million USD, down 3.5% in volume and 4.3% in value compared to the same period last year.

Notably, in October 2023, Vietnam's average coffee export price to the US recorded a record high of 3,586 USD/ton, up 9.9% compared to September 2023 and up 45.1%. compared to October 2022.

However, the coffee industry also faces many challenges, such as climate change causing output to decrease, farmers' profits are unstable, and our country's coffee area is tending to shrink; The rate of processed coffee has increased but slowly.

Not to mention, from the beginning of 2025, Vietnamese coffee businesses must also proactively meet the latest requirements of the European market and resolutely not import coffee grown on deforested areas or causing forest degradation. Along with strong fluctuations in trade, sustainable production trends, and quality issues, the domestic coffee industry must make efforts to adapt to maintain its 2nd global export position

Bao ngoc