News

News

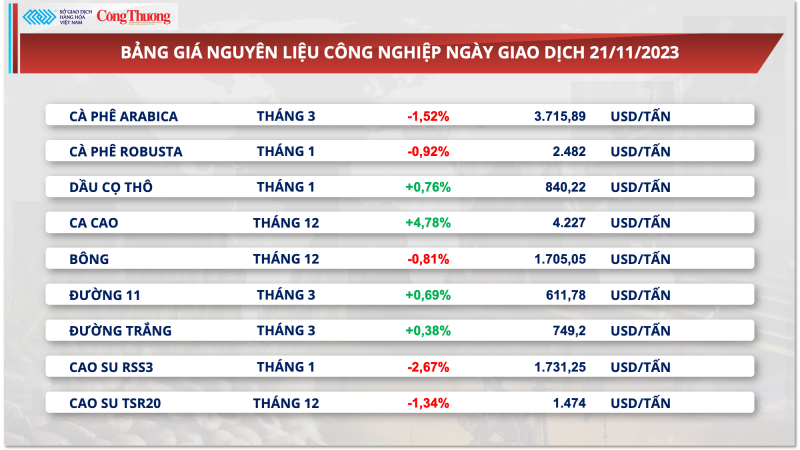

According to the Department Vietnamese Commodity Trading (MXV), closing date of trading on November 21, price coffee Robusta extended its decline for the third consecutive session when it lost 0.92% and Arabica price was 1.52% lower than the reference. MXV said that the coffee supply in the two leading producing countries, Brazil and Vietnam, both had positive signals, putting pressure on prices yesterday.

|

| Coffee prices turned down |

Brazil's domestic Real fell sharply, pushing the USD/BRL exchange rate up nearly 1% compared to the reference. Exchange rate differences have motivated Brazilian farmers to sell coffee to earn more foreign currency. Besides, statistics from the Brazilian Coffee Exporters Association (CECAFE), this country exported 2.76 million bags of coffee in the first 20 days of November, an increase of 14% compared to 2.42 million. bag in the last month.

Furthermore, the return of rain to Brazil's main coffee growing region is a good sign for the development of the 2024/25 crop year, thereby leading to a more positive supply outlook.

As for Robusta, Reuters reported that Vietnam has harvested 10-20% of coffee as planned for the 2023/24 crop year. The availability of new coffee crops has boosted export activities. According to the General Department of Customs, in the first half of November, our country exported 36,968 tons of coffee, twice as high as the same period last month.

On the domestic market, recorded this morning, the price of green coffee beans in the Central Highlands and Southern provinces continued to weaken by 500 VND/kg. Thus, domestic coffee has continuously decreased in the last 4 days, bringing the purchasing price to 57,100 - 57,800 VND/kg.

|

| Vietnam's coffee export prices have remained anchored at high levels for many years |

Although coffee prices have tended to decrease in recent days, the outlook for coffee exports is still very positive. According to the General Department of Customs, coffee export prices are the highest in the past 30 years, averaging more than 2,600 USD/ton in the past 2 months, up 17% over the same period last year. This crop year, Vietnamese coffee exports are expected to earn more than 4 billion USD.

According to the Vietnam Coffee and Cocoa Association (VICOFA), besides the European market, China's demand for green coffee and instant coffee is also increasing, opening up great opportunities for Vietnam to boost exports. export to this market. Currently, about 210,000 hectares of coffee in the Central Highlands have applied international standards 4C, UTZ, Flo... to participate in global value chains. The promotion of linkages to build high-quality coffee areas has been responded to by coffee growers. At the same time, it is also a solution towards sustainable coffee export.

Also according to VICOFA, although coffee prices are forecast to increase in the near future, it is expected that in the 2023-2024 coffee crop, output will decrease by 10% due to the effects of climate change, the intercropping area will increase, and farmers will invest more. Invest in crops with high economic efficiency such as durian and fruit trees. Currently, coffee trees are being competed by three types of trees: pepper, avocado and durian, but the main competitor is durian, because the profit people earn from durian trees is about 500 million to 1 billion. VND/hectare, while the profit from coffee trees is only about 200 million VND/hectare, so it is very difficult to get farmers to keep coffee gardens.

However, currently, rising coffee prices will be an advantage for farmers to keep coffee gardens, but in the long term, forming stable chain links associated with new brands is the path to sustainable development. .

Kim CUong