News

News

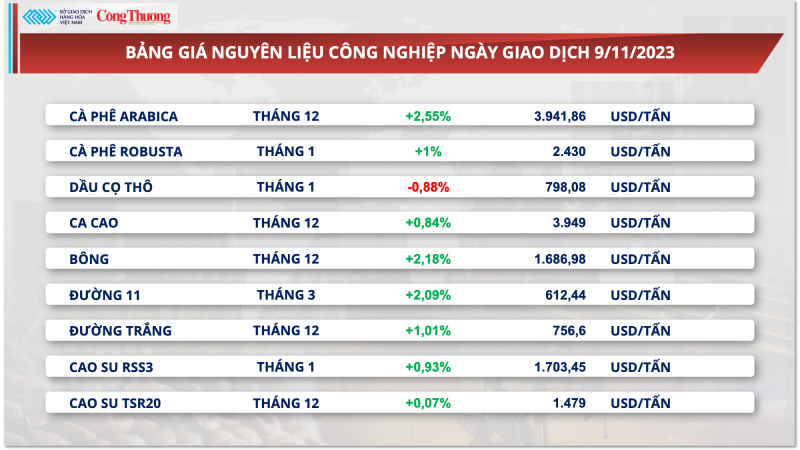

According to the Vietnam Commodity Exchange (MXV), closing the trading session on November 9, green almost covered the price list of industrial raw materials. In particular, the prices of two coffee products, Arabica and Robusta, increased by 2.55% and 1%, respectively. Thus, Arabica prices have reached their highest level since mid-June 2023. Coffee inventories on the Intercontinental Commodity Service (ICE) continue to decline, concerns about tight supply have double-supported price increases.

|

| Coffee prices continue to skyrocket |

In the closing report on November 9, the standard Arabica inventory on ICE-US Department decreased by 8,266 bags of 60kg, bringing the total number of coffee in storage to 302,235 bags. This is the lowest amount of coffee inventory since April 1999.

Furthermore, Vietnam's coffee exports in October only reached 43,725 tons, down 14.2% compared to the previous month and nearly half lower than the same period in 2022. This figure reflects the amount of coffee from the old crop. of the world's largest Robusta producer has run out, while the new coffee crop is not ready to be pushed to the market.

|

| The strategic direction of Vietnam's coffee industry until 2030 is to continue promoting processed coffee products (roasted and ground coffee, instant coffee...) rather than focusing on the quantity of green coffee. |

According to the Import-Export Department - Ministry of Industry and Trade, in the third quarter of 2023, Robusta, Arabica and Excelsa coffee exports decreased by 45.5%, 69.2% and 66.7%, respectively, while processed coffee exports variable increased by 11.4% compared to quarter 2/2023. Compared to the third quarter of 2022, exports of most coffee types decreased, but processed coffee grew by up to 33.9%. This shows that Vietnamese processed coffee is increasingly popular, including instant coffee.

Regarding actual consumption demand, data from the International Trade Center (ITC) shows that global instant coffee import turnover has set a new record of more than 6 billion USD in 2022, an increase of 18%. .6% compared to 2021.

With today's population's busy schedules, convenient, fast, affordable and accessible food and beverages are becoming increasingly popular. This will help develop the instant coffee market. This is considered an opportunity for coffee exporting countries, including Vietnam.

According to experts, processed coffee is considered one of the solutions to the problem of increasing added value for the coffee industry, aiming for an export target of 6 billion USD by 2030.

Although accounting for less than 10% of the country's total coffee exports, processed coffee export turnover accounts for more than 19% of industry revenue. The average export price of processed coffee in the first 9 months of this year amounted to 5,413 USD/ton, 2.5 times higher than the price of green coffee.

In the FTAs that Vietnam has signed, all markets are open to Vietnamese processed coffee products with preferential tax rates from 0-5%. This is considered an advantage for Vietnam to compete with other leading exporting countries such as Brazil, Indonesia...

The strategic orientation of Vietnam's coffee industry until 2030 is to continue promoting processed coffee products (roasted and ground coffee, instant coffee...) rather than focusing on the quantity of green coffee because of the problem. Past studies show that if the area is increased further, oversupply and falling prices will return.

Kim Cuong