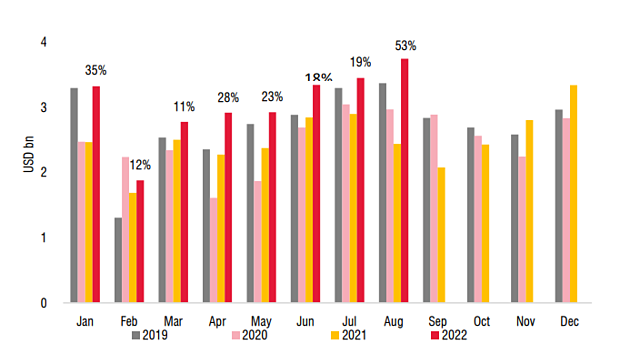

According to the textile and garment industry update report of SSI Research, Vietnam's textile and garment export turnover reached 31.3 billion USD in the first eight months of the year, up 16.4%. In which, garment export turnover reached 24.3 billion USD, up 24.6% and yarn export turnover reached 3.5 billion USD, down 5%. Exports to the US reached 12.9 billion USD, up 22.5% over the same period and accounting for 41% of total export turnover.

In August 2022, garment exports reached $3.7 billion, up 53%. SSI Research considers this to be a record-high month-to-month result both in terms of growth rate and in absolute terms. Some companies such as TNG Textile (HNX: TNG) and Thanh Cong Textile (HoSE: TCM) still receive a large number of orders for delivery for the festive season in the third quarter of this year.

However, SSI Research believes that the situation in the fourth quarter will not be positive. Regarding orders, this unit thinks that textile companies will face difficulties from the fourth quarter to the first 6 months of 2023 due to concerns about inflation and high inventories of customers. In the first half of September 2022, textile and garment exports reached $1.2 billion, down 48% compared to the first half of August 2022, indicating a significant slowdown in orders. The number of orders in the fourth quarter was 25-50% lower than in the second quarter (equivalent to a 15-20% decrease in revenue over the same period according to SSI Research estimates)

In particular, the impact will be more severe for businesses with customers mainly in the US and EU than those with large customers in Japan and Korea. Thanh Cong Textile and Garment has export revenue to Japan and Korea, accounting for 40% of total revenue. SSI Research believes that similar companies may record lower revenue declines than those more focused on the US and EU markets such as Song Hong Garment (HoSE: MSH) and Gilimex (HoSE: GIL).

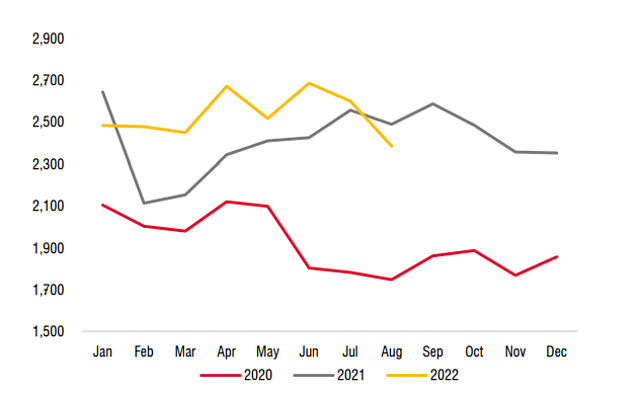

Regarding the selling price, most of the customers are negotiating to reduce the order. CMT orders, orders for which customers only have to pay labor costs, are also currently being pressured. Yarn manufacturers saw their average selling price drop by 8% year-on-year in August.

In terms of raw material costs, cotton and polyester yarn prices have dropped recently. Companies forecast fabric costs will start to fall in the fourth quarter as demand has not yet recovered.

Regarding the impact of exchange rate, although textile companies all record their revenue in USD, most of the expenses are also recorded in USD such as raw material costs, logistics costs and interest expenses. The USD/VND exchange rate is forecasted to continue to decrease in the second half of 2022, which will continue to negatively affect the business results of businesses, especially those with high dollar costs such as: Century Yarn (HoSE: STK), Thanh Cong Textile and TNG Textile.

With the above influences, SSI Research forecasts that textile enterprises will record a decrease in revenue and a net loss in the first 6 months of 2023.