The stock market continuously encountered strong resistance around the peak, causing the shaking to continue with a large amplitude. Most of the industry groups were under strong selling pressure but Fertilizer stocks were still "well alive", even going against the market with the green color. DPM, DCM, BFC, LAS, VAF, PMB,... all increased strongly to attract cash flow.

In fact, the wave of fertilizer industry started from the end of January 2022 when these stocks continuously broke out with many hot gaining sessions. In the last 2 months, stocks like DPM (+80%), DCM (+75%), BFC (+65%), LAS (+52%), PMB (+38%), VAF (+44 %),... all outperformed many other industry groups and VN-Index in the same period.

The flourishing movement of Fertilizer stock was supported by positive information on both prices and export volumes. These two factors are forecasted to boost the profit growth of fertilizer enterprises in the coming time.

According to the General Department of Customs, the country's export of fertilizer from the beginning of 2022 to the end of March 15 reached 395,222 tons (a sharp increase of 53.8% over the same period), earning nearly $264.8 million. Previously in 2021, the country's fertilizer export also reached a record in volume with more than 1.35 million tons (up 16.4% over the same period), earning 559.35 million USD (up 64.2%) compared to 2020).

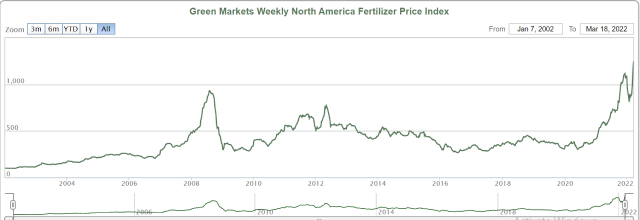

In terms of prices, the fertilizer price index in North America on Bloomberg's Green Markets channel for the week ended March 18 was $1,248 per tonne, compared with $1,138 per ton in the previous week, an increase of nearly 10%. Compared to a month ago, when the war in Ukraine broke out, the price of this item increased by 40% and was the highest in history.

The progress of the world fertilizer market depends greatly on Russia because this country is the world's leading fertilizer exporter. A recent report of Mirae Asset said that the world's fertilizer reserves are declining, which may put upward pressure on fertilizer prices to continue in the second quarter of 2022. The pressure on fertilizer supply in the world continues to increase when Russia officially stops exporting fertilizers, besides the demand for food production, it will also boost fertilizer demand.

According to Mordor Intelligence, Vietnam's fertilizer industry will grow 4.9% per year in the period 2021-2026 with the expectation of coming from new projects and imports. The gross profit margin of enterprises in the industry may increase sharply when it is expected that the growth in selling price will be higher than the growth in input costs.

Sharing the same view, SSI Research also believes that the Russia-Ukraine tension can prolong the shortage of natural gas in Europe and create short-term investment opportunities for Vietnam's fertilizer stocks, which can benefit. from the higher selling price of Urea. Urea prices will decline at a slower pace from their peak in December 2021 as Urea supplies in Europe are expected to be short, and Urea supplies in China grow slowly and export restrictions are ongoing.

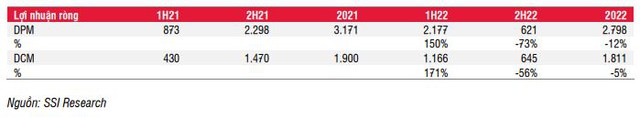

According to estimates by SSI Research, in the first 6 months of 2022, profits of Phu My Fertilizer (code DPM) and Ca Mau Fertilizer (code DCM) can achieve impressive growth thanks to low Urea prices in the first 6 months of 2021. and high export prices in January 2022 (export prices were pegged at a high in December).

On the other hand, this analyst thinks that DPM and DCM's 2H2022 profit may decline year-on-year assuming that the coal shortage in China will ease and farmers can no longer bear it. fertilizer prices are high.